Hi there fellow business owners,

Your financial reports tell you the story of your business; allowing you to interpret the results of your business activity. The better you understand your financial reports, the better your decision-making and results will be.

We want to share the benefits of understanding your numbers, give you an overview of the standard reports and provide helpful tips on using them to improve your business. Where possible, we’ve avoided jargon and ‘Accountanese’, however, if you need further support or guidance from us, please do get in touch.

The benefits of knowing your numbers

Knowing your numbers will allow you to:

- Understand whether your business is growing or shrinking

- Track trends over time

- Compare results to your expectations (as set in your budget)

- Compare results between years or different periods

- Identify areas of strength and weakness

- Measure your business efficiency

- Measure the value of your business

- Identify symptoms of underlying problems

- Measure your cashflow

Make better business decisions

“You don’t have to be an accountant or bookkeeper to understand your numbers; just as you don’t have to be a mechanic to drive a car.”

Knowing your numbers puts you in a far stronger position to make informed decisions and measure the impact of those decisions on your results, enabling you to take corrective action.

This guide is designed to be general in nature and is no substitute for specific one on one advice. We strongly recommend you talk to us about your unique situation and how we can help you improve your business.

Previously we went over the Profit & Loss + Balance Sheet reports.

Today we have some Tips for starters when learning how to use your financial reports

No matter which report you’re looking at, there are fundamentals to consider and understand:

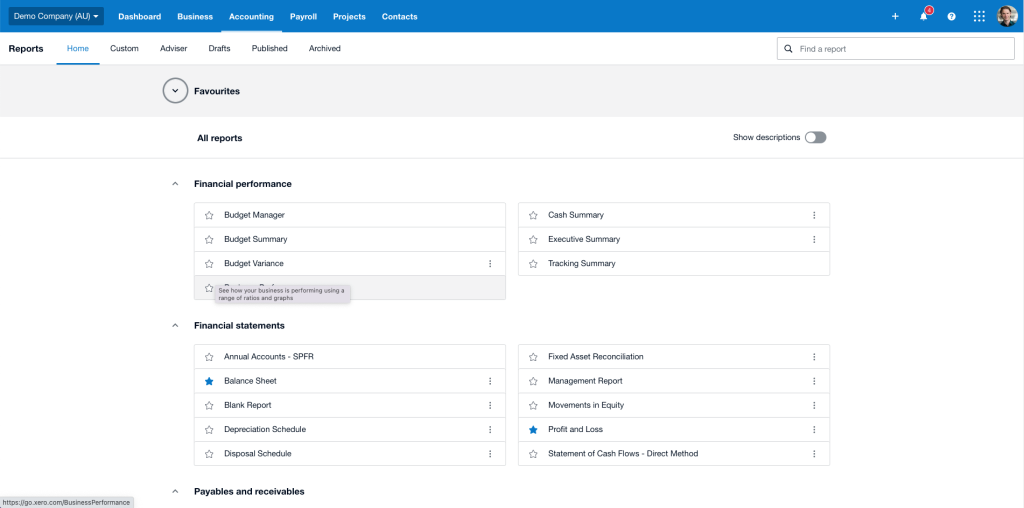

1. Is the data ‘clean’? Most software packages allow you to export your own reports. We see here an example of some of the different reports available through xero.

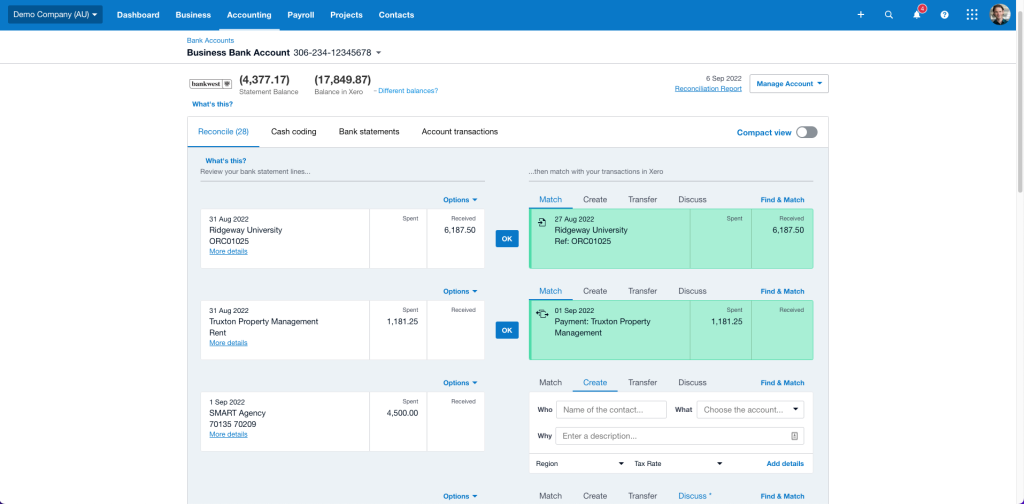

While this gives you flexibility, the data can be unreliable if transactions haven’t been coded correctly or bank statements haven’t been reconciled. As you can see here in this example, there are multiple unreconciled transactions in the bank which means the reports generated will not be accurate for that period.

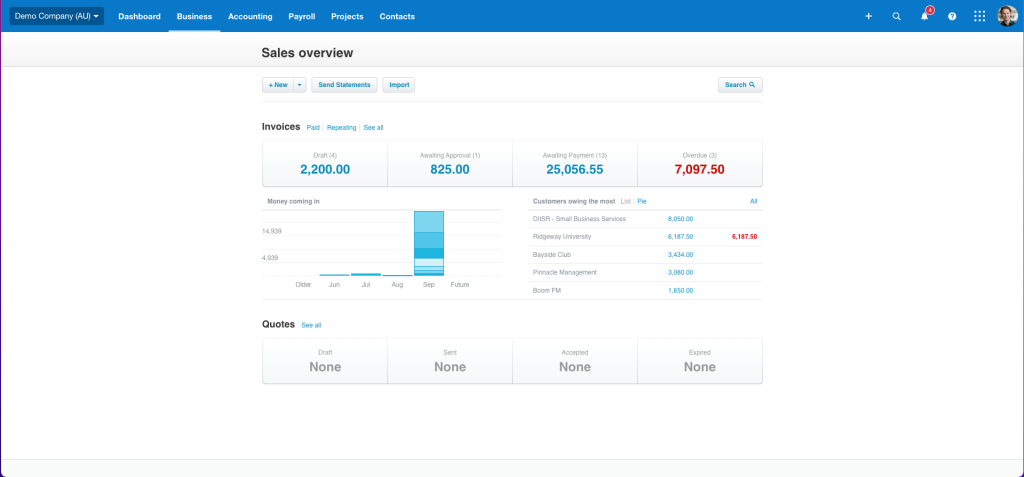

Likewise, if monthly invoicing hasn’t been completed, sales reports could be understated. You can see here in this example there are still draft invoices & awaiting approval invoices which might be affecting the accuracy of the reports.

Contact us for information on the monthly procedures you should follow to keep your data ‘clean’.

2. Inspect what you expect. Your reports are a representation of what you planned for your business. For example, you may have set a sales or gross profit target in your Business Plan and Cashflow Forecast (what you expected). Your reports can then be used to inspect if you’re on track to achieve those targets.

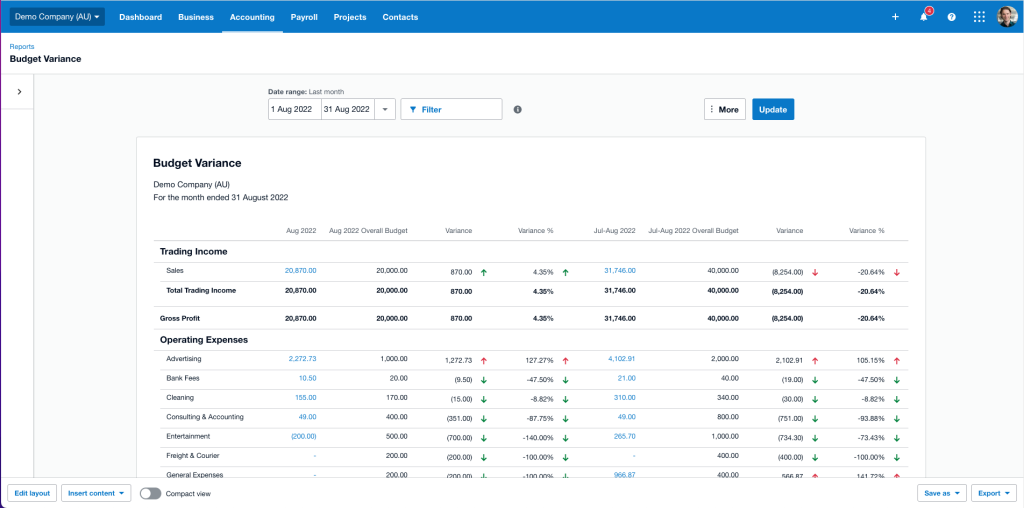

Looking at this example of a budget variance report, we can see that sales for august were more than planned, however the year-to-date for July and august is less than budgeted. Likewise in the expenses we can see that the advertising spend is above what was planned. These reports give us insights in the areas we should be focusing our attention when running the business.

3. Know which reports to use. Trading Accounts and Profit & Loss Statements measure income and expenses; the Balance Sheet measures assets, liabilities and net worth. There are different versions of each report, e.g. for the Profit & Loss you can measure this year vs last year, this period vs the same period last year, or this period vs the budget you set.

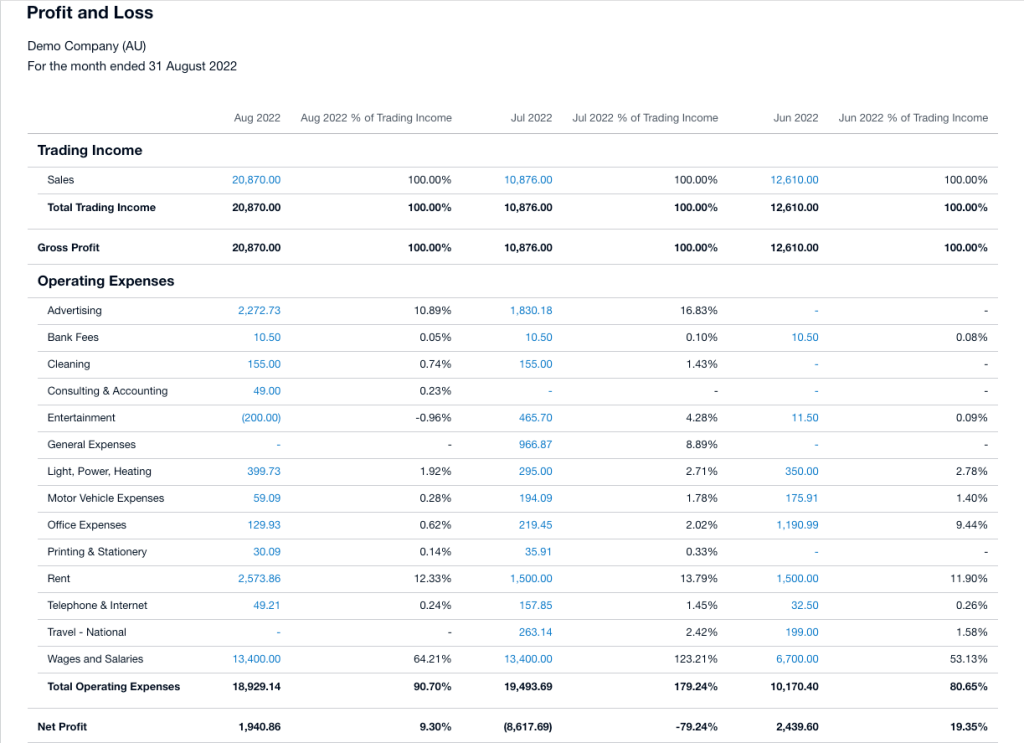

In this example we have setup the profit & loss report to compare the last 3 months income & expenses.

Talk to us about the most appropriate reports for your business.

4. Go horizontal and vertical when analysing your financial reports. A horizontal analysis compares the results of previous periods, – in this example comparing the August Gross Profit to the July & June Gross Profit. This shows whether your results are improving over a specified period.

A vertical analysis calculates each item in the statement as a percentage of a base item, – in this example we are calculating the expenses as a percentage of the sales. This is a way to easily identify key expenses to keep track of & work on improving the efficiency of your business. Conducting both helps identify specific areas of potential improvement.

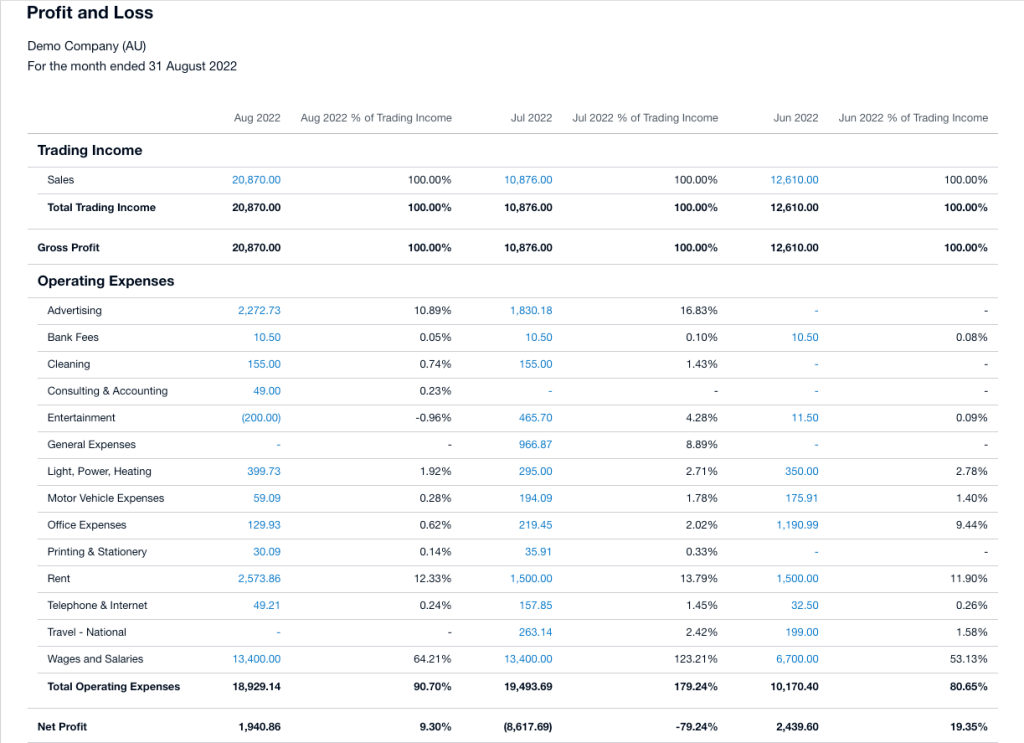

5. ‘As at’ or ‘for the period ending’. An ‘as at’ report shows the balances at the end of a specific period, – in this example the Balance Sheet shows asset and liability balances at the end August & compares them to the previous 2 months. This allows us to see how the value of our assets & liabilities are changing.

In this example we see that the accounts receivable has increased significantly in August compared to July. This highlights that we need to focus our attention on collecting the cash from the sales generated in our business.

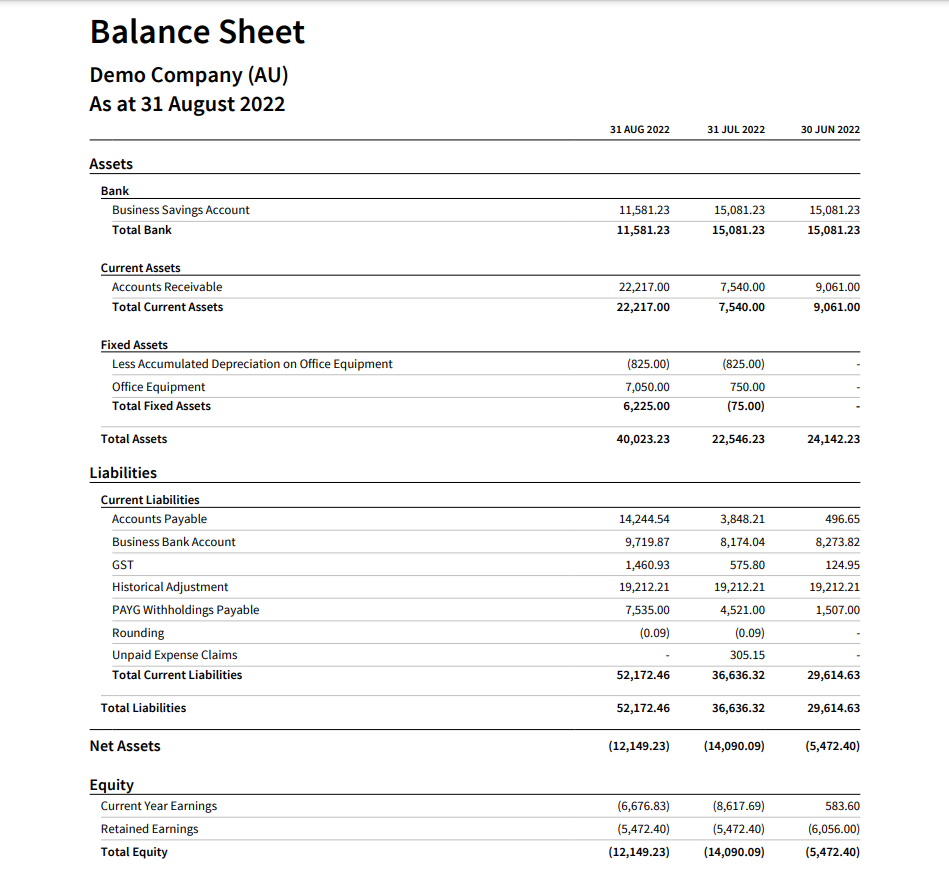

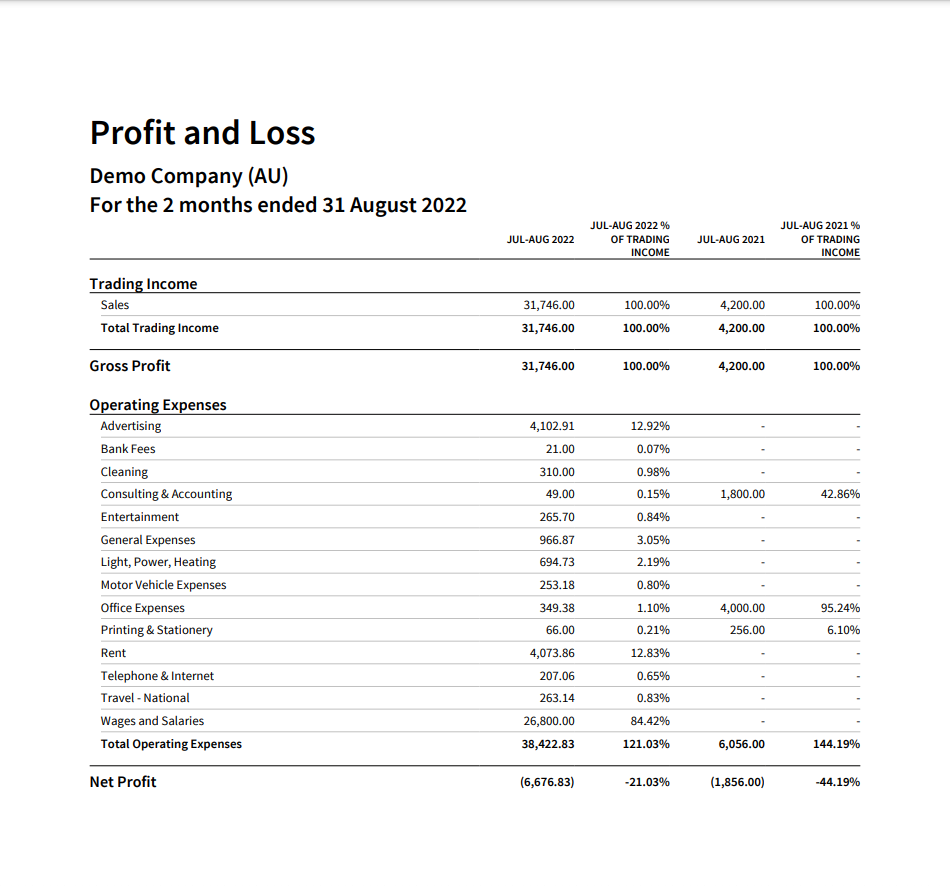

A ‘for the period ending’ report shows the results over a period of time, – in the next example the Profit & Loss shows the Net Profit over July & August compared to July & August in the prior year.

6. Choosing the date range. For a period ending report, ensure you correctly specify the start and end date for the period you want to measure. For example, this report shows July & August compared to July & August in the previous year. We can see here that whilst the business has increased sales significantly compared to the last period, however expenses have also increased significantly. The starting point in this business would be to improve the wages % – either by increasing sales or decreasing wages.

It’s best practice to choose a date that is a month end date, e.g. if you want to print a report on 15 July, set the date range to end on 30 June, as you should have all income and expenses coded and reconciled for the period ending 30 June, but may not have coded and reconciled them for July yet.

Book a call HERE and we will help you!

Mick

I’d love to help you achieve your business dreams, please don’t hesitate to contact me;

07 5646 4050

mick@ignitionaccountants.com

Digitally enhanced by

Digitally enhanced by